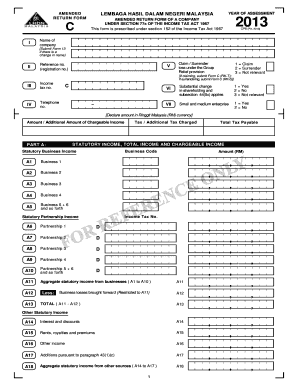

Lhdn Form C 2019

Explanatory notes to form c for year of assessment ya 2019 irin 300 page 2 e download these forms from iras website under home quick links forms businesses corporate tax forms failure to submit the form and the requisite documents will lead to a disqualification of the company s claim where applicable.

Lhdn form c 2019. E enter in the relevant box. 2019. The extended filing deadline of 15 dec which was initially introduced in 2012 to encourage companies to e file their corporate income tax returns will no longer be available from 2021. Visitors this year.

Company tax estimate form cp204 company tax estimate form amendment 6 cp204a amendment 6 company tax estimate form amendment 9 cp204a amendment 9 what are the requirements of e filing. 2 nov 2020. 1 september 2019 until 31 december 2019 two 2 months grace period from the due date of submission is allowed for those with accounting period ending 1 january 2020 until 31 march 202 0 form c companies 31 july 2019 30 sep 2019 30 nov 2019 31 jan 2020 31 mar 2020 29 feb 2020 30 apr 2020 30 june 2020 31 aug 2020 31 oct 2020 30 apr 2020 31 july 2020. Registration no income tax no.

2019. Jumlah pengguna tahun. From the year of assessment ya 2020 e filing of form c s c is compulsory for all companies the filing deadline is 15 dec 2020. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor.

Income tax reference number and pin number.